DORA - Digital Operational Resilience Act

The rapid digitization of the European financial sector in recent decades has made technology integral to financial operations, ushering in new risks. Financial institutions have attempted to address these risks through controls and contingency plans, but many struggle to establish robust defenses against ICT-related risks. Operational resilience efforts have often been disorganized, resulting in weak controls and inadequate backup plans. Additionally, insufficient management information leaves board members and senior managers unaware of elevated ICT risks. Recent high-profile disruptions at European banks have underscored the industry's vulnerability.

To address this, the European Council aims to enhance operational resilience while harmonizing national regulations. The Digital Operational Resilience Act (DORA) provides a comprehensive framework for managing ICT risks in European financial institutions. DORA consists of five pillars covering ICT risk management, incident reporting, resilience testing, third-party risk, and information sharing. Compliance with DORA is challenging and necessitates a purposeful, business-led technology strategy and integrated risk management aligned with critical services.

The potential benefits of improved operational resilience are significant, including reduced financial losses, smoother system implementation, maintained customer service levels, enhanced brand value, lower risk management costs, and reduced regulatory risk. Building digital operational resilience is no longer optional and requires engagement from all levels of the organization, including business lines, senior management, and boards.

Why is DORA relevant to you?

This regulation shifts its focus beyond merely ensuring the financial stability of firms. It extends to guaranteeing their ability to maintain resilient operations in the face of severe disruptions, particularly those stemming from cybersecurity and information and communication technology (ICT) issues.

DORA introduces a unified supervisory approach applicable to a diverse array of financial market participants. This includes entities such as credit institutions, payment institutions, account information service providers, electronic money institutions, investment firms, insurance companies, crypto-asset service providers, exchanges and clearing houses, alternative fund managers, pension providers, credit rating agencies, and more. By doing so, DORA aims to foster convergence and harmonization in security and resilience practices across entities operating within the European Union (EU).

Fulfil your DORA requirements with Skillfinder International

Why chose us?

Skillfinder International and Coventus Consulting offer the expertise and capabilities necessary to navigate the complex terrain of DORA's regulatory requirements. Our goal is to support you in achieving your organization's resilience objectives. With a wealth of experience in assisting clients with compliance to UK regulatory requirements, we bring unique insights into the correlations and intersections with DORA's mandates.

Our global network includes industry experts prepared to collaborate with your technology risk function, as well as your existing operational resilience, cybersecurity, and third-party risk management programs. Additionally, we are well-equipped to work alongside your in-house legal teams, identifying and addressing any gaps in your digital and operational resilience maturity.

How long will it take to implement DORA?

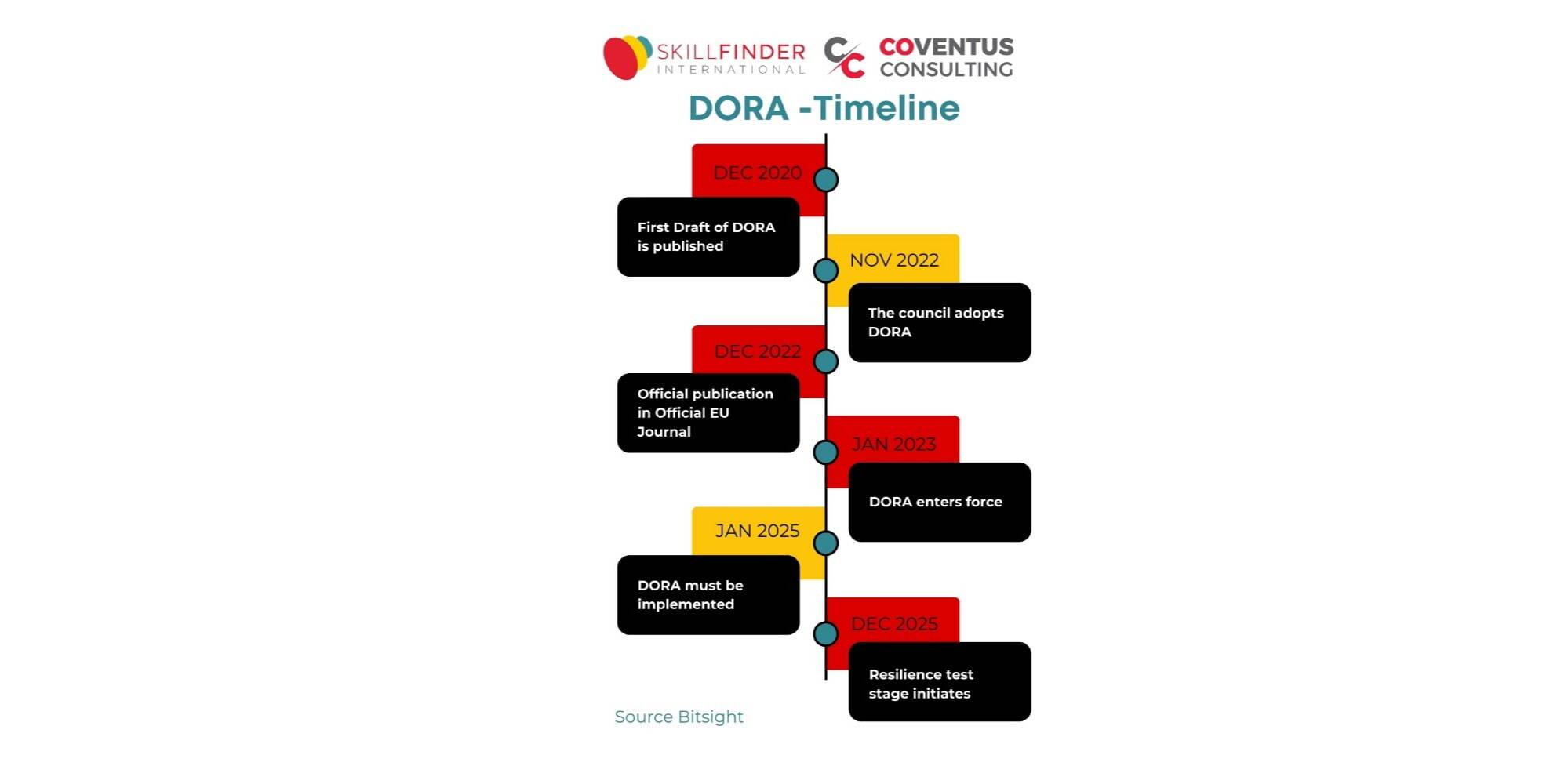

We recommend that companies operate under the assumption that fulfilling all of DORA's requirements can take about 24 months but this is entirely dependent on which strategic direction you take, starting from the second half of 2022 and concluding by the second half of 2024.

We're less than a year away from when DORA must be implemented in your company.

Let us help you fulfill your DORA staffing requirements

Statement of Work

We'll create the right team and manage your outsourced projects to deliver the outcomes your business needs.

Get in touch with our consulting services director, Stuart Egerton